The government has imposed a staggering total of nine different taxes. And duties on the average electricity bill. This unwavering imposition of taxes has sparked debates. About the financial burden placed on citizens, as electricity bills. Become more expensive as a result of these numerous levies. Are such ridiculous taxes collected?

Electricity Tax Deatils

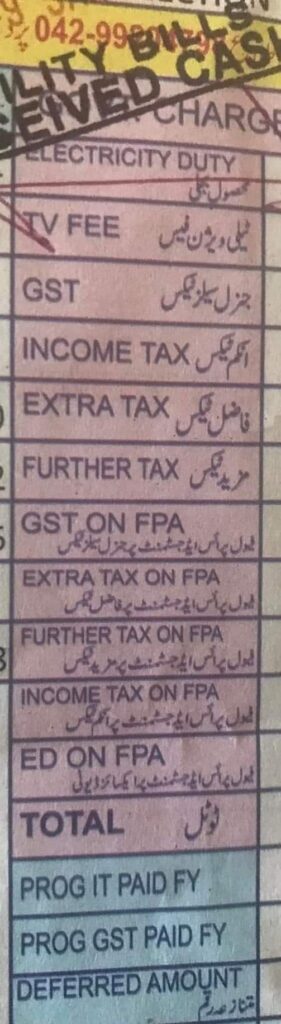

The Ministry of Energy (power division) provides a comprehensive. Breakdown of the various taxes and duties imposed on bills, which include:

- Electricity Duty: A provincial levy of 1% to 1.5% of variable charges that applies to all consumers.

- General Sales Tax (GST): Under the Sale Tax Act of 1990, all consumers pay a 17% tax on their entire electricity bill.

- PTV License Fee: A supplementary charge of Rs35/for customers at home. And Rs60/for commercial consumers is added directly to their electricity bills.

- Finance Cost Surcharge: The charge is Rs0.43 per kWh and applies. To all consumer categories except lifeline domestic consumers.

- Fuel Price Adjustment (FPA): A variable component that represents the difference. Between actual and reference fuel charges. Positive variations result in additional charges on consumers’ electricity bills. Whereas negative variations provide a benefit to consumers.

- Extra Tax: Industrial and commercial consumers. Who are not on the Federal Board of Revenue’s (FBR) active taxpayer list. Are taxed at a rate ranging from 5% to 17%, depending on bill amount slab.

- Further Tax: A 3% additional tax is levied on all consumers. Who do not have a Sales Tax Return Number (STRN), with the exception of. Domestic, agricultural, bulk consumers, and street light connections.

- Income tax is charged at varying rates depending on the applicable tariffs. And the value of the electricity bill.

- Commercial buyers are taxed at a rate of 5% on payments up to Rs20,000/ and 7.5% on bills greater than Rs20,000/-.

The staggering number of taxes and duties has resulted in an alarming reality. Pakistan has one of the highest rates of taxation on utility bills in the region.

This burden has resulted in significant increases in electricity bills. Putting a strain on ordinary citizens’ finances.

Comments are closed, but trackbacks and pingbacks are open.