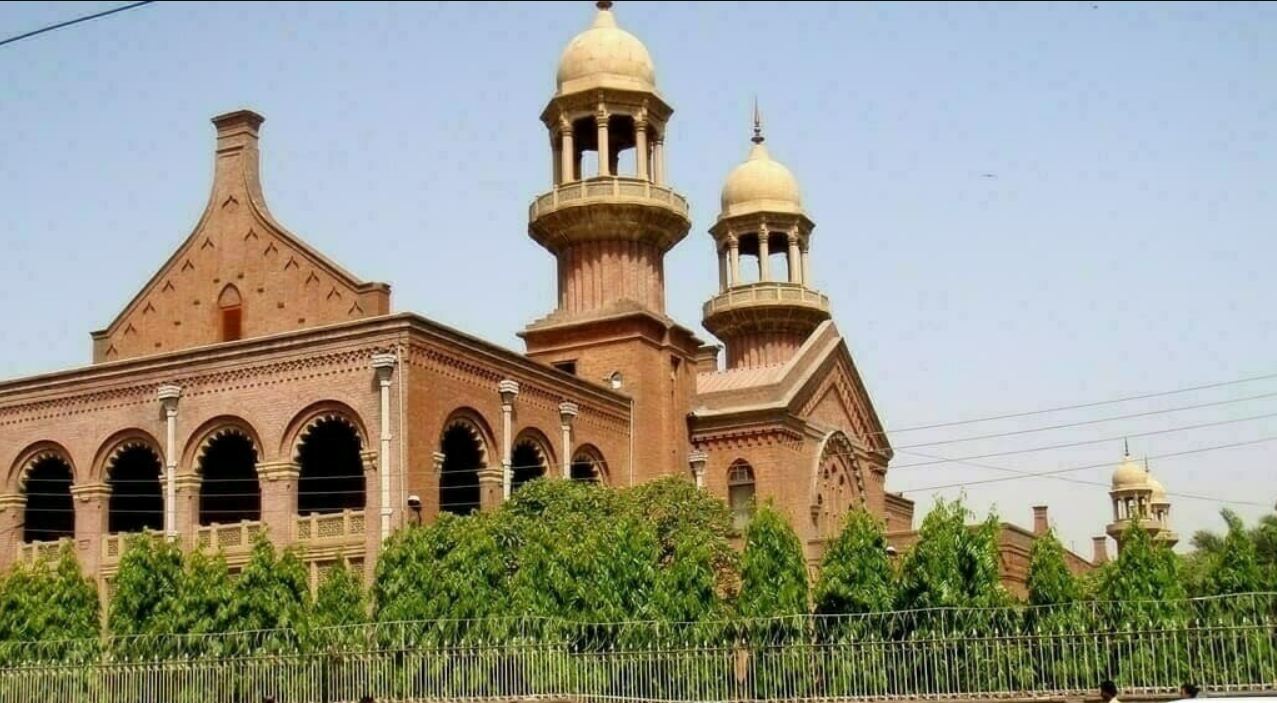

The Lahore High Court (LHC) has temporarily stopped the implementation of SRO 350(I)/2024 and instructed the Federal Board of Revenue (FBR) to accept sales tax returns from taxpayers without incorporating the recent changes made in the sales tax rules under SRO 350(I) 2024.

According to sources, many taxpayers have been encountering difficulties in filing their monthly sales tax returns due to the recent amendments introduced through SRO 350(I)/2024. A large number of taxpayers are unable to submit their returns due to various technical issues.

Although the FBR has issued clarifications and relaxed certain conditions, the return filing process has still not become fully functional.

As a result, many taxpayers have been forced to turn to the courts and have subsequently filed petitions before the LHC. In response to the petitions, the LHC has suspended the application of SRO.350 until the next hearing on October 8, 2024, and has directed the FBR to accept sales tax returns from the affected petitioners based on the previous module.

The legal counsel for the petitioners argues that the contested notification S.R.O. 350(1)/2024 should not have been issued under section 50 of the Sales Tax Act, 1990, as that provision only empowers the Board to make rules for carrying out the purposes of the Act through an official Gazette notification.

The amendment in question modifies rule 18 of the Sales Tax Rules, 2006, and diminishes the petitioners’ rights under section 7 of the Sales Tax Act to adjust input tax to determine the tax liability of a registered person. Furthermore, the amendment makes the filing of the return and the deduction of input tax contingent upon the filing of the return by the respective seller for the same tax period.

In summary, according to the petitioners’ legal counsel, the said amendment infringes upon the petitioners’ rights as established by law and guaranteed under the Constitution, particularly under Article 18.

This petition raises important legal questions and has been scheduled for regular hearings. Notices on behalf of respondents are to be submitted by the Deputy Attorney General (D.A.G.) present in court, who will inform the respondents to file their written statements and arrange for legal representation at the next hearing.

Additionally, a notice will be issued to the Attorney General for Pakistan, which will also be accepted by the D.A.G. Until the next hearing, the returns filed by the petitioners for May and June 2024, as well as subsequent returns, will be accepted by the Federal Board of Revenue (FBR) and will not be blocked.

However, this is subject to further notice and the hearing scheduled for the next date, by the Lahore High Court order. Furthermore, the FBR Chairman has been informed that a case titled ‘Ashiana Cotton Products Limited and others Vs.

Federation of Pakistan, etc.’ has been filed on behalf of clients, challenging the legality of the amendments to Rule 18(3) of the Sales Tax Rules, 2006, through clause 2(b) of S.R.O 350(I)/2024 dated 07-03-2024. This challenge has been lodged before the Lahore High Court, which has issued notices and required the FBR to provide detailed responses before the next hearing

The FBR Chairman has been informed about a legal case, ‘Ashiana Cotton Products Limited and others Vs. Federation of Pakistan, etc.’, which challenges certain amendments to the Sales Tax Rules, 2006. The Lahore High Court has issued notices and requested comments from the FBR in response to the challenge.

The petitioners have been unable to file their sales tax returns for June 2024 due to issues with the IRIS system, which they believe is not their fault. The Court noted that the amendments in question do not permit blocking taxpayers from filing their sales tax returns and directed the petitioners to approach the FBR Chairman to resolve the issue and allow them to file their returns for June 2024 and subsequent months.

Following the Court’s order, a request to unblock the petitioners and allow them to file their sales tax returns for June 2024 and subsequent months has been attached. The FBR Chairman is urged to take immediate action and unblock the petitioners. Failure to do so may result in the Court being informed of appropriate action

Comments are closed, but trackbacks and pingbacks are open.