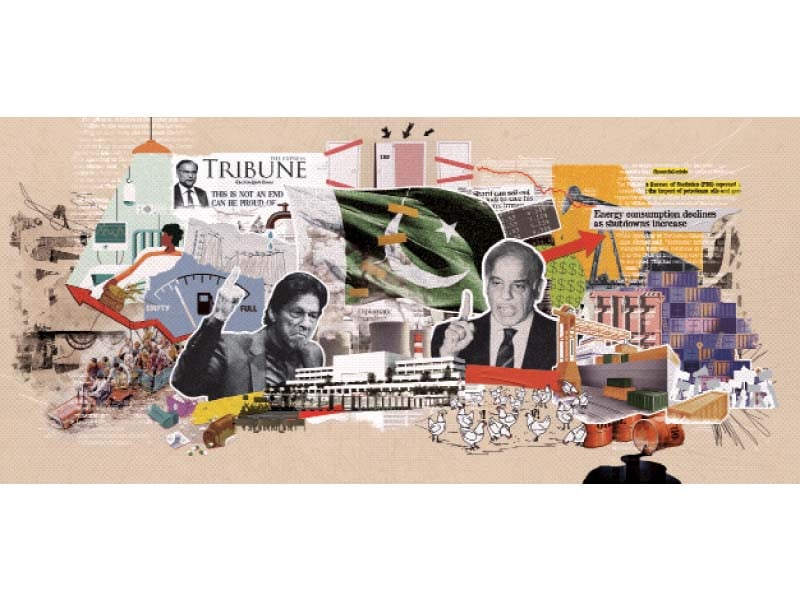

Prime Minister of Pakistan Shehbaz Sharif has a limited amount of time to decide quickly. Whether to move forward with his plans to present a popular budget. That would further enrage foreign creditors. It is now necessary to find a long-term, durable framework for economic revival. In order to prevent the impending default, so this is his only remaining option.

It is our hope that the government can guide the economy away from default and out of crisis. But in the event of a sovereign default, people won’t have enough money to buy necessities. And both government and private importers will need hard currency. To buy anything from cooking oil to medicines and pulses.

In addition to high costs and interest payments eating up government revenue. Asovereign default will cause hyperinflation. Which will reduce the purchasing power of the average person’s salary.

Although Pakistan’s leaders boast proudly that their country has only defaulted once. They are not alone in this regard.

Amidst severe political and economic turmoil. Sri Lanka also experienced its first-ever default in April of last year. Pakistan is currently experiencing similar factors. That are gradually driving the country toward a default scenario.

Roughly 147 governments have fallen behind on their sovereign debt since 1961. KTrade, a KASB research engine, lists Argentina, Sri Lanka, Russia. And Lebanon as recent examples.

“Markets are well-stocked, and restaurants in the capital, Colombo, are full.” Zeinab Badawi stated in the Financial Times in February of this year. That “travels around the central mountain region. And the small villages are also deceptive.”

There’s something similar going on in Islamabad, where elites in the city. And policymakers think the nation won’t default.

As per the May 19 analysis by JP Morgan Chase Bank, Pakistan is expected. To possess adequate external liquidity to meet its financing requirements through June. However, in fiscal year 2023–2024, default risks rise dramatically. The analysis went on to say that Pakistan “faces the material risk of running out of usable reserves. To meet foreign obligations at some point in the second half of 2023.”

There is no high default risk associated with Pakistan. According to Finance Minister.

Many people now view Sri Lanka as an extreme illustration of the negative effects. That high levels of borrowing can have on weaker nations. The situation in Pakistan is the same.

Similar to Sri Lankans, who, according to the Finance Times. “now seethe with anger,” Pakistanis are also said to be resilient.

With just $4.1 billion in foreign exchange reserves. Enough to cover the debt repayments due in June alone. Pakistan’s reserves are dangerously low.

Pakistanis are in for a catastrophe

The people of Pakistan will encounter a lifestyle they have never known. If the government is unable to come up with sufficient plans to pay. Back the $25 billion debt by the end of the next fiscal year, whether. Or not the International Monetary Fund (IMF) provides assistance.

There will be a collapse in 250 million people’s living standards. Food, fuel, and medication shortages—which were already severe. Because of import restrictions put in place by the Sharif administration. In an effort to postpone default—will get worse. The depreciation of the rupee will persist, resulting in hyperinflation brought on. By fluctuations in exchange rates. Import restrictions might be forced upon the government. Which would be detrimental to businesses that depend on imported raw materials.

According to Arif Habib Research last week. Sovereign default causes serious economic instability, undermines investor confidence. And makes it more difficult to access international financial markets. Sovereign default is more likely if there is no progress with the IMF. Whose approval often determines support from friendly countries.

Collapse of currencies

The rupee will be the biggest loser in the event of a default. Because its open market value has already dropped to as low as Rs313 to the US dollar.

As people rush to get their hands on any spare foreign cash. The value of the rupee relative to the US dollar will become erratic.

All purchases made from overseas will need to be made with cash. And no bank will establish credit accounts.

The Sri Lankan rupee was valued at about 200 to the US dollar prior to the default. Before the official default announcement on April 12, it dropped to 322, and then it dropped to 370 to a dollar. However, since getting a bailout from the IMF in March of this year, it has steadily increased to 298 to the dollar.

Since Pakistan’s economy is largely dependent on imports. It will be severely impacted in such a scenario. Hyperinflation will be brought on by the currency’s devaluation. Everything will become more expensive due to the exchange-rate shock. Including imported fuel, pulses, and medications.

Trade limitations

Despite significant anomalies, Pakistan’s economy is said to have expanded. By just 0.3% during the current fiscal year. The government’s imposition of import restrictions. In order to prevent default is one of the causes of this flat growth rate.

Formerly averaging $6.5 billion per month, the average monthly import bill has. Since fallen to as low as $3 billion in April. Although this has avoided default. It has resulted in shortages of goods and factory closures.

The nation will no longer be able to import goods worth up to $3 billion on credit in the event of default.

It will be extremely difficult for Pakistan to import necessities like machinery, medicine. And petroleum if it defaults on its debt. Eighty percent of Pakistan’s imports are estimated. By the World Bank to be made up of intermediate goods. Raw materials, and necessities.

Consider the effect it would have on day-to-day living if someone wanted to import a good. But the bank required payment in advance. Money will become a valuable resource.

According to Arif Habib’s research, the lack of raw materials, energy shortages. And the cancellation or transfer of export orders. To more stable competitors will also negatively impact exports.

Overinflation

Pakistanis are currently experiencing the highest rate of inflation in 59 years. And part of the cause of the record 36.4% inflation is currency devaluation. In the case of a default, price increases will happen more quickly. And consumers will compete for the few items on the market.

Global markets and banks will stop doing business with Pakistan.

The government’s incapacity to obtain sufficient foreign loans. To meet the lender’s requirements is one of the factors contributing to the delay. In arriving at a staff level agreement with the IMF. Foreign commercial banks will either refuse to lend in the event of a default. Or will demand interest rates that are difficult for any government to accept.

Pakistan may also lose budget support loans. From multilateral banks like the World Bank. Asian Development Bank, and Asian Infrastructure Investment Bank. Unless it consents to debt restructuring with the lenders.

Domestic banks, which currently hold government debt on more. Than 60% of their balance sheets, will also be impacted by sovereign default. They stand to lose everything, even the face value of the loans they took out from the government.

The economy will shrink.

Prior to the default, there have been reports of disparities. In data and information sources suggesting that Pakistan’s economy shrank. By at least 0.5% as opposed to the 0.3% growth rate that the National Accounts Committee had approved.

A default would cause a more severe contraction that would impact every area of the economy. Increase unemployment, and worsen poverty. This might exacerbate political unrest and possibly lead to social unrest.

Pakistan still has time to avert disaster

Only after Colombo and its international creditors agreed. To restructure its foreign debt owed to China, India, Japan, and commercial bondholders. Did the IMF agree to lend $3 billion to Sri Lanka.

Early decisions on domestic and foreign debt restructuring can avert social. And economic disaster. A Chinese rescue plan could postpone the inevitable. But it won’t deal with the underlying issue.

Some Facts

Salary of a common person is old but almost double the house rent now

- School fees 80% higher

- Books with 1000 copies Rs.5500,

- 300 gas bill Rs 4500,

- 2000 electricity bill Rs 15000,

- 800 flour 2200 rupees,

- 150 ghee 600 rupees,

- 6 loaves of bread Rs. 25,

- 30 of 10

- A plate of 50 chickpeas Rs. 150,

- 2200 Vala Motorcycle Tire Tube Rim Rs.6000,

- 150 petrol Rs 300 per litre,

- 20-vala chinchi fare Rs.50.

- 1500 shalwar kameez 3000 rupees,

- Doctors fee Rs 2500 and Rs 3000,

- 150 medicine 600 rupees,

If all this happens, what will the white-clad 25. 30 thousand earner do, where will he go Total destruction seems certain. Believe it or not, at least 60% of the country’s white community has defaulted.May Allah have mercy and grace on all of us.

Ameen

Comments are closed, but trackbacks and pingbacks are open.