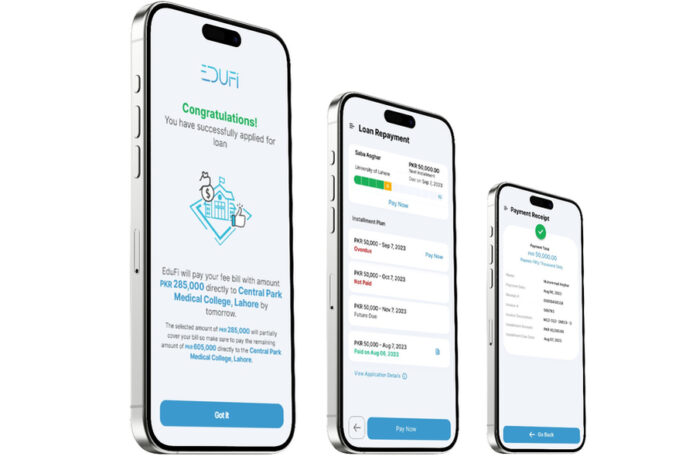

Higher education in Pakistan has long been out of reach for many due to the lack of affordable student loans. Unlike in the United States, where student loan programs are widely available, Pakistani students must rely on high-interest personal loans that often require collateral. As a result, only about 13% of Pakistani students attend college. EduFi, founded by MIT graduate Aleena Nadeem, is solving this problem by offering low-interest student loans with no collateral required. The company uses artificial intelligence-based credit scoring to approve borrowers and pay tuition directly to colleges. In return, students and their families repay the loan in monthly installments with a minimal 1.4% service fee—a fraction of what traditional banks charge.

Breaking Down Barriers to Higher Education

“The fees for college are extremely unaffordable for the average middle-class person right now,” explains Aleena Nadeem. “With our ‘Study Now, Pay Later’ system, we’re breaking that big upfront cost into manageable payments, making higher education a reality for many who never thought it was possible.”

After securing regulatory approval in 2021, EduFi disbursed over half a million dollars in loans within its first six months. The response has been overwhelmingly positive—today, less than 1 in 10,000 loans are in default, proving the model’s success.

How EduFi Works

Unlike banks, which have lengthy approval processes and high rejection rates, EduFi has streamlined the lending system by:

Using AI to assess creditworthiness quickly and fairly

Paying tuition directly to colleges to prevent misuse of funds

Offering affordable repayment plans with a 1.4% service fee

Eliminating the need for collateral

By making education loans more accessible, EduFi is opening doors for students across Pakistan, particularly those who would otherwise struggle to afford college.

Expanding Impact: From Pakistan to the Middle East

With its successful track record in Pakistan, EduFi is now planning to expand to Saudi Arabia and eventually across the Middle East. Inspired by models like SoFi in the U.S. and Grameen Bank in Bangladesh, EduFi aims to redefine global student financing by combining financial inclusion with technology-driven lending.

“Education is the foundation of a nation’s progress,” says Nadeem. “By making education affordable and accessible, we’re not just helping individuals—we’re accelerating the development of entire countries.”