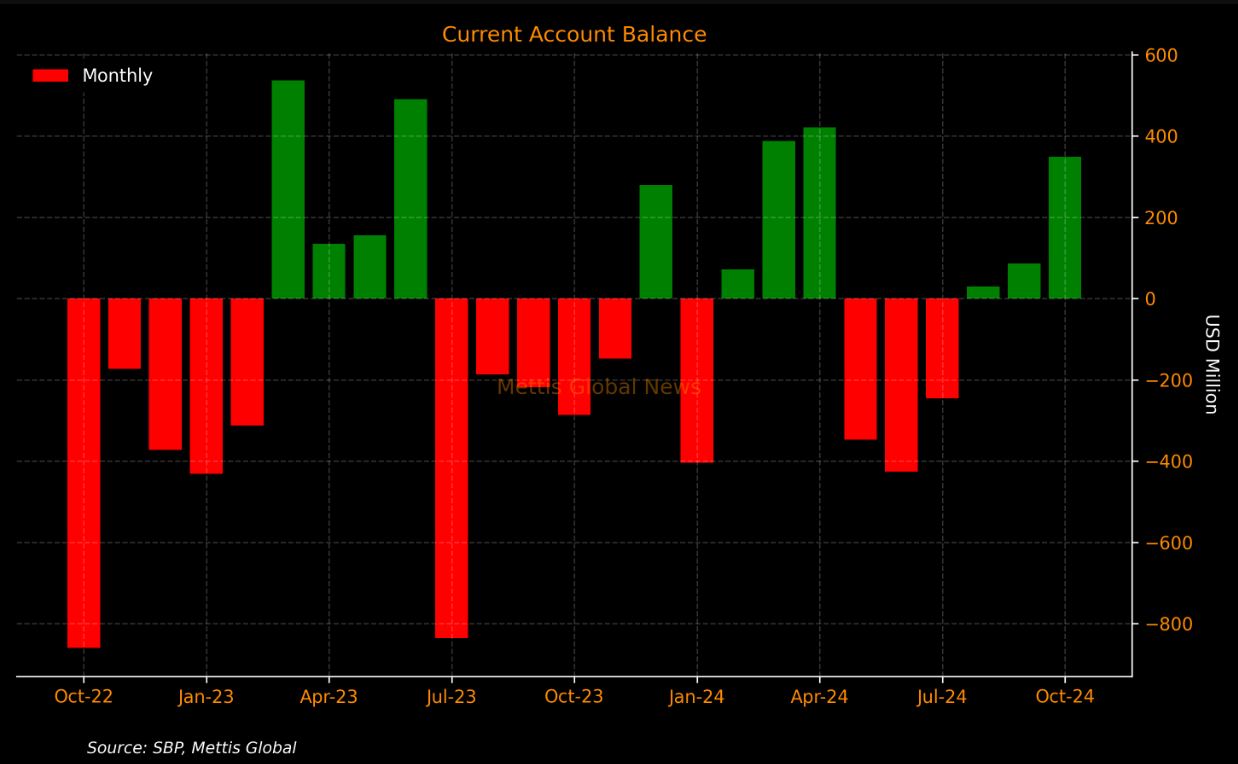

Current account surplus record of $349 million in October 2024

Pakistan’s current account was in surplus of $349 million in October this year.According to data released by the State Bank of Pakistan (SBP), Pakistan’s current account was in surplus of $349 million in October, while a deficit of $287 million was recorded in the same period of the previous fiscal year.This is the third consecutive month of current account surplus.Muhammad Sohail, CEO of Topline Securities, said in a note that this surplus was recorded due to a 7 percent increase in remittances and a 24 percent annual increase.In September 2024, the surplus was reported to be $119 million, but the State Bank revised it to $86 million in the latest data.Overall, this figure has brought Pakistan’s current account to a surplus of $218 million in the first four months of the current fiscal yearWhile a large deficit of $1.528 billion was recorded in the same period of the previous fiscal year.Breakdown

The country’s total exports of goods and services in October 2024 stood at $3.711 billion, up about 12 percent from $3.327 billion in the same month last year.According to the State Bank, imports during October 2024 stood at $5.558 billion, an increase of 7 percent year-on-year.Workers’ remittances stood at $3.052 billion, up 24 percent from the previous year.Rising inflation along with low economic growth has helped reduce Pakistan’s current account deficit and an increase in exports has also helped in this regard.High interest rates and some restrictions on imports have also helped policymakers in their goal of reducing the current account deficit.

Latest updates

Comments are closed, but trackbacks and pingbacks are open.